CB&S Bank was incorporated as Citizens Bank on February 28, 1906 and opened its doors for business on March 3, 1906. The bank was started with $25,000 in capital. The photo beside shows the Wilson Building, where Citizens Bank first opened its doors.

In 1906, Russellville, Alabama was not exactly the most opportune place to establish a bank. It was far removed from the country’s financial centers, with a farm economy highly dependent on the weather and the whims of the commodity markets. Yet William H. Key, Sr., Charles E. Wilson, and Foster Gavin weren’t interested in obstacles. Instead, the three founders of CB&S Bank focused on the unmet needs of farmers and town merchants alike. The three of them, along with other investors, pulled together $25,000 in seed money and incorporated the bank as Citizens Bank and Savings Company on February 28, 1906. Of course, CB&S Bank began with far more than capital. We opened our doors on March 3, 1906, with a vision to provide extraordinary service to the people of the region, staking our own growth on the growth of the region. It certainly wasn’t easy, yet we survived boom, bust, depression, and war to emerge as an indispensable financial partner for the people of northwest Alabama. As the 20th Century grew old, however, we began planning a new era of expansion. We at CB&S Bank realized that our blend of cutting-edge financial products and traditional customer service could serve people well beyond Franklin County.

As the bank has grown and expanded throughout the region, we increasingly ran into other Citizens Banks. So effective March 3, 2008, Citizens Bank officially changed its name to CB&S Bank.

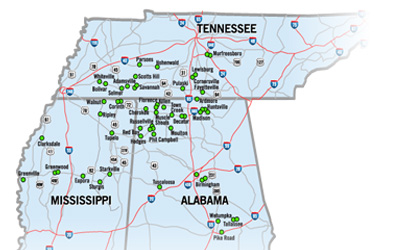

As a result, we began to expand beyond our traditional markets, moving into bigger cities and crossing state lines. In 2000, CB&S Bank entered the Mississippi market, and in 2006, we expanded into Tennessee. Through the years, we continued to expand our footprint by acquiring banks and opening new locations. CB&S Bank’s current footprint expands over 50 offices in three states, all across the Southeast.

CB&S Bank’s Current Footprint

If our founders dropped by today for a visit, they would be amazed at what they would find. Our traditional teller cages have been replaced with smiling customer service representatives. The handwritten ledgers have vanished, replaced by state-of-the-art Internet Banking that allows customers to conduct business any time of the day or night–innovations that we take for granted today but would have been nothing short of miraculous over 100 years ago. At the same time, amid all the new technology and changes in the financial business, our founders would instantly recognize one thing about CB&S Bank: our total commitment to the needs of our customers and our shareholders; it’s the philosophy that has propelled our growth in good times and bad. As we plan for the next century of growth, this philosophy is the way CB&S Bank will enjoy a prosperous, stable, and secure future.

CB&S Bank is a leading community bank with over $2 billion in assets, headquartered in Russellville, Alabama, operating 56 branches in the Alabama, Mississippi, and Tennessee markets. Employing over 500 people company-wide, we offer a complete line of full-service banking products and other related financial services to retail and commercial customers through our subsidiaries.